Evolving FCA expectations in 2026: a wealth management roundtable

by Stephanie Coleman

by Stephanie Coleman

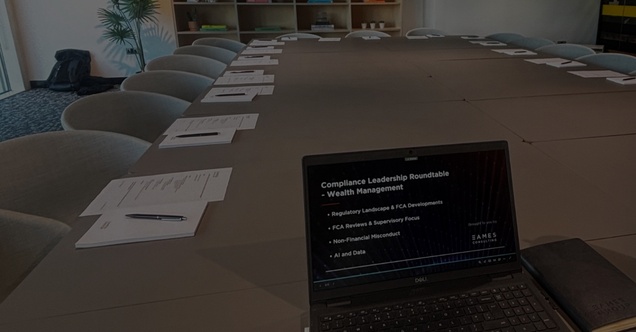

Eames Consulting hosted a compliance leadership in wealth management roundtable in our London office on Wednesday 4th February. Daniel Billin and I were joined by 11 chief compliance officers from leading wealth management businesses to discuss the regulatory landscape and Financial Conduct Authority (FCA) developments; FCA reviews and supervisory focus; and non-financial misconduct. Here are the key takeaways from the roundtable.

FCA reigniting Consumer Duty

As the FCA enforces its Consumer Duty regulation by shifting from initial implementation to active, data-driven supervision, there was a feeling among our attendees that there will be a significant impact on wealth management firms. Firms are responding by increasing their focus on Consumer Duty dashboards over the next year, gathering data to evidence their Consumer Duty outcomes and compliance with FCA requirements.

Customer testing is helping firms embed good customer outcomes in line with Consumer Duty. As they increase their focus on how they engage with their customers, they’re doing a lot of work to strengthen their first line of defence.

M&A activity having a direct impact on hiring strategies

There’s a lot of M&A activity in the wealth management sector right now. The smaller, more traditional firms are proving an ideal sweeping ground for the larger firms – who have better data, superior platforms and more robust digital transformation – to build up their assets under management. The general consensus in the market is that the tone from the regulator is different in 2026, with the FCA working more cohesively with wealth management firms.

When it comes to hiring, consolidation is driving demand for broader group-wide roles and candidates with multi-entity experience, while post-merger integration and regulatory change are fuelling targeted interim and project hiring.

Targeted Regulatory Support is a positive development

As a result of new regulatory guidance, some firms now don’t get a specific supervisor from the regulator. Released in December 2025, Targeted Regulatory Support is a new FCA framework allowing firms to offer tailored, ready made investment or pensions suggestions to groups of consumers with similar characteristics. This means they can provide more personalised support without having to conduct often onerous individual suitability assessments, which many investment platforms and banks say is a good thing.

Non-financial misconduct now an FCA issue

New rules on non-financial misconduct will come into force in September 2026, providing firms with a clear regulatory framework for addressing serious workplace misconduct. These behaviours will now be viewed not just as HR issues but matters of regulatory concern. There was a feeling among our attendees that non-financial misconduct shouldn’t necessarily sit with compliance, and that compliance teams will need to work very closely with HR teams in order to manage this challenging area effectively.

Join us for our next roundtable

These events are a great opportunity to get under the hood of the regulatory priorities across wealth management in 2026, as well as the current market pressures firms are facing. They allow us to better understand gaps within teams and, most importantly, to build strong professional relationships across the market.

Many thanks to the chief compliance officers who joined us for an engaging discussion. If you’d like to talk to me in more detail about the current trends in the wealth management sector, want to bring in the right governance, risk or compliance leader for your organisation, or are looking for your next opportunity to make a difference to a wealth management firm, please get in touch with me.

Fresh Content

Explore our latest market insights, career advice, and more.