Our expertise

What we do

To succeed in a constantly evolving competitive landscape, businesses need capable and efficient partners who can help them be more strategic in how they hire and transform their business, not merely to survive, but to change and grow.

Our contract offering provides clients access to our established network of contractors across the insurance, banking and financial services market. With over 20 years of refined expertise, our contractor network is highly skilled, loyal and professional. You’ll be further supported by our award-nominated Compliance and Contractor care team, who ensure our contractors are compliant, informed and receive the support they need.

We work in partnership with our clients to develop hiring strategies and approaches to suit their needs. Our global network of talent has been refined over 20 years. We have fast access to professional, relevant candidates, and are agile in our approach to sourcing talent outside of our existing database. From market mapping to named approaches, we tailor our permanent solutions based on the needs of our clients. We can work with you on a contingent basis, or retained and exclusive projects, giving you more visibility and control.

Our comprehensive services extend beyond conventional executive search, encompassing invaluable market insights and rigorous leadership assessments. Delivered by Eames Partnership, we provide our clients with a deeper understanding of the talent landscape. We are a firm focused on high-quality execution rather than just selling it.

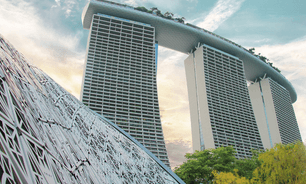

Where we are

We have offices in six cities across the globe and counting. From the USA to the UK and Asia, we're well-positioned to support our clients and candidates wherever they are in the world.

Insights

Explore our latest market insights, career advice, and more.